Pictet Asset Management - Seven trends to watch in 2024

The key trends to look out for in science, technology and sustainability over the next 12 months – and beyond.

1. Generative AI goes professional

Generative AI dominated the headlines in 2023, and fuelled strong gains in tech stocks. Now that the hype of the new technology has died down, the next challenge for developers is how to monetise it. Companies are increasingly looking to embrace technology to improve efficiency and become cost effective, creating strong demand for professional applications of generative AI. It probably won’t steal your job – after all, generative AI requires human input for initiation and subsequent refinement and fact checking – but it could make you more productive. Microsoft’s GitHub Copilot is the best scaled example of generative AI in software today. In a study released by Microsoft, developers coding with it were more productive, delivering improved output in 55 per cent less time, all for around USD100 a year for their "co-pilot" subscription. Salesforce, meanwhile, has recently launched Einstein Copilot, whose skills include generating marketing emails, providing personalised answers to customer questions and summarising calls. That’s just the beginning: across all industries, three-quarters of companies expect to be using AI by 2027. [1]

2. Deep fakes challenge cyber security

While generative AI might make us more productive, it can also disseminate harmful disinformation. Deep fakes – media which simulate family, friends, bosses or colleagues via video or audio calls – are ever easier to create and ever harder to spot. And it’s not just calls: with the help of AI, well-targeted, highly personalised spear-phishing emails which deploy malware are already starting to replace clumsy generic text and PDFs. Ransomware attacks have risen significantly since the launch of generative AI, as malware becomes much quicker to create. This poses a big challenge for the cyber security industry. On the flip side, the growing threat is likely to lead to more investment, spurned on by regulatory pressure. We are likely to see a rise in zero trust solutions that continuously verify the credentials of individuals interacting with an organisation, both internally and externally. AI may also be part of the solution, as the cyber security industry adapts large language models (LLMs) to detect attacks more quickly and to counter potential threats from malicious code written by other machines.

3. Climate change battle heats up

In the battle against climate change, much of the focus so far has been on mitigation – cutting greenhouse gas emissions and removing the carbon that’s already in the atmosphere. But as temperatures continue to rise, it’s becoming clear that mitigation is not working fast enough. To survive, we will need to adapt to the higher temperatures and ever more frequent extreme weather such as droughts, floods and hurricanes. At the COP28 conference in Dubai in November last year, countries agreed on targets for the Global Goal on Adaptation (GGA), although there are still question marks over how those efforts will be funded. The annual financing shortfall for adaptation is running at USD366 billion, according to the UN Environment Programme (UNEP).[2] The private sector will have a key part to play in plugging that gap. And the opportunities are diverse, including growing crops that can survive droughts and thrive in a changing climate, developing climate-resilient infrastructure, constructing flood defences, designing heat-reflecting buildings, leveraging big data to better predict the next extreme weather event or setting up early warning systems. With 2024 likely to set new weather records [3] adaption will be a major priority.

It's becoming clear that climate change mitigation is not working fast enough. To survive, we will need to adapt to higher temperatures and extreme climate events.

4. The high rise of green buildings

As more of us move into cities, we need more buildings to live, work and have fun in. Historically, construction has been problematic for the planet: the real estate sector accounts for around 40 per cent of global carbon emissions and the construction process can also generate a lot of waste. That is now changing thanks to innovations in technology and building materials. For example, Building Information Modelling (BIM) software enables digital modelling and analysis across the lifecycle of buildings and infrastructure from planning and design to construction and operations. BIM not only incorporates tools to analyse environmental factors such as energy, thermal and lighting but can also facilitate pre-fabrication which improves build efficiency. And, inside buildings, technology is also helping to reduce emissions and maximise comfort, such as through better insulation or IoT connected lighting and building control systems. Global investment in energy efficiency of buildings has increased from USD140 billion in 2015 to an estimated USD190 billion in 2021, according to the International Energy Agency.

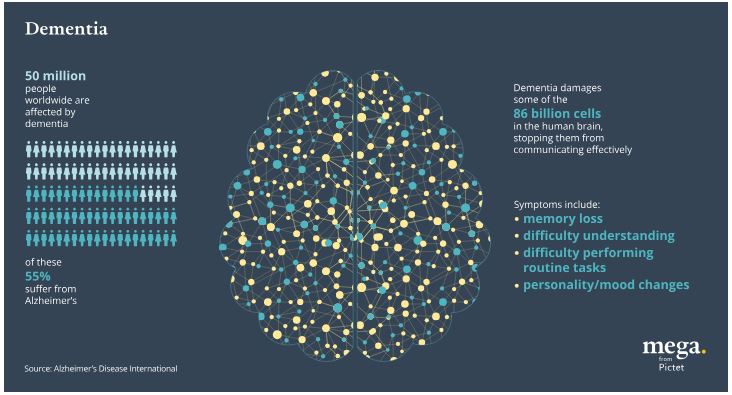

5. Glimmers of hope for Alzheimer’s disease

Alzheimer's disease has confounded scientists for decades. It affects nearly 30 million people worldwide, as well as their families who often provide care. The burden is expected to increase as the population ages. Fortunately, we are finally seeing some signs of progress in treatment and diagnostics. US authorities have recently approved an Alzheimer’s drug from Eisai/Biogen, and the companies’ subcutaneous formulation which could be easier to administer is also expected to be filed for approval. In the coming year, all eyes are on the launch of the newly approved therapies, Eisai/Biogen’s lecanemab and Eli Lilly’s donanemab. These new therapies focus on the removal of a protein called amyloid beta from the brain. Additionally, as tools such as blood-based diagnostics become available, the hope is that in the future Alzheimer’s disease patients may be able to begin treatment earlier in the disease progression that in turn could lead to better outcomes.

6. Active lifestyle back in fashion

New Year health and fitness resolutions often falter after a few weeks or even days. But there is a growing evidence that the desire to lead a more active life is more than a seasonal fad. Covid underscored the importance of overall good health, and also gave many people the time to embrace new hobbies. A few years on, the fitness industry continues to thrive, with gyms taking over empty retail sites on the High Street and strong appetite for increasingly advanced gadgets to track and encourage progress. In the coming year, the Olympics in Paris could add fresh momentum to the drive for active lifestyles and healthier food. Meanwhile, the success of a new breed of weight loss drugs designed to mimic the glucagon-like peptide 1 (GLP-1) hormone, like Wegovy, could further increase demand for healthy lifestyles. Having lost weight, people may find exercise more accessible and may also be more committed to staying fit.

7. The experience economy on the rise

In both US and Europe, spending on recreation and cultural activities has been growing more than twice as fast as the wider economy. Research suggests that spending money on experiences versus material goods can provide more enduring happiness as those experiences can be shared with others. Technology is opening up new ways to interact, including through virtual reality and esports. But offline, too, there is growing demand for experiences, including in retail and tourism. The travel boom seen in the last couple of years is expected to continue in 2024, aided by live translation devices and generative AI-designed itineraries. Shared experiences are also becoming an increasing priority for authorities, with the US Surgeon General warning that loneliness poses risks as deadly as smoking.

[1] Future of jobs: technology skills workplace

[2] Climate adaptation funding gap

[3] First chance of year above 1.5c

Important Information

This article is used for informational purposes only and does not constitute,on Pictet Asset Management part, an offer to buy or sell solicitation or investment advice. It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date. The effective evolution of the economic variables and values of the financial markets could be significantly different from the indications communicated in this document.