Pictet Asset Management - Beyond abundance?

For a number of reasons, we are moving to a world where natural resources previously taken for granted are becoming scarcer.

Economies are inherently about transformation

Food is produced from seeds, soil, nutrients, air and sunlight. We make houses from wood, steel, glass and concrete, most of which were themselves derived from basic materials such as sand, iron ore, aluminium ore, coal and limestone.

Plastics, which have become ubiquitous in our everyday lives, are typically derived from fossil fuels such as petroleum. And at the core of any transformation, of course, lies energy, in all its forms. All these components, therefore, are the critical resources on which economies rely to produce and distribute the goods and services we consume.

Has economics failed to account for resources properly?

Concerns about the limited availability of natural resources are not new. Eighteenth-century French physiocrats led by François Quesnay [i] assumed that agriculture and land were the sole basis for economic growth and that shortages of cultivable land would place a constraint on future expansion. At the end of that century, English economist Thomas Robert Malthus [ii] laid forth concerns that food production would fail to keep up with population growth, as the former could only be expanded linearly while the latter was starting to rise exponentially. Sixty years later, William Stanley Jevons [iii], another English economist, warned against the consequences on the economy of the exhaustion of English coal mines.

While Adam Smith – and, later, David Ricardo [iv] and John Stuart Mill [v] – viewed natural resources as critical inputs to production, they dismissed the risk of resource depletion in their analysis as they did not see it as an imminent problem. John Stuart Mill, for instance, argued that mining should be viewed as similar to the working of land – the resources needed for both being seen as inexhaustible [vi].

At the turn of the 19th century, Jean Baptiste Say infamously wrote that “natural resources are infinite because, if they weren't, we would not obtain them freely. Since they cannot be multiplied, nor exhausted, they cannot be the object of economic sciences” [vii]. Granted, he was referring primarily to land use rather than the extraction of mining resources. But Say started a long tradition of economics disregarding the fundamental issue of the availability of natural resources. The peak of such disdain was likely reached in the 20th century, starting with the so-called ‘marginal revolution’ led by Alfred Marshall, Leon Walras and Irving Fischer, who focused on margin utility, or the benefit to be gained from consuming one additional unit of a product or service. Concentrating on the income-expenditure cycle, they dismissed natural resources as a major driver of growth. So did Robert Solow, who revolutionised growth theory in the mid-1950s. Solow’s exogeneous growth model [viii] relied exclusively on capital accumulation, labour and productivity (i.e. technological progress). In the post-war economic boom, when growth seemed unending, the natural world was effectively absent from modern macroeconomic theory.

The natural world was absent from macroeconomic theory for a long time.

This is not to say that exhaustible resources were entirely discarded from economic thinking in the mid-20th century. Harold Hotelling proposed an extensive analysis of the intertemporal optimisation of extraction paths for such resources in 1931. He formulated what became known as the “Hotelling rule” [ix], widely considered to be the starting point of non-renewable resource economics. Yet his research focused on the price and pace at which the owners of such resources should sell them rather than the impact of scarcity on overall macroeconomic conditions.

The integration of resource scarcity in macroeconomic thinking emerged from the 1970s onwards, especially after the oil shock of 1973. The publication of ‘The Limits to Growth’ by the Club of Romex aimed to show that there were indeed constraints on long-term economic growth stemming from the availability of resources and rampant population growth. Adding to the criticism of conventional economics, the concept of natural capital, developed in the same decade [xi], aimed to show that natural resources such as soil, water, plants and all living organisms were essential to the sustainability of human life and economies. In the 1980s, economists began to incorporate environmental externalities such as pollution and climate change in their models, leading to the development of environmental economics. More recently, the idea of the ‘circular economy’ has been gaining traction as a way to solve issues related to availability, affordability and the environmental impact of ever-accelerating demand for natural resources.

The more progress we make in attaching a proper value to the natural resources at hand, the more we realise that considering economic health simply through the lens of GDP distorts some fundamental issues. Worse still, the notion of scarcity, which decades ago many influential economists had naively put aside, is making a dramatic comeback and is likely to occupy economic thinking for decades to come.

Scarcity is making a dramatic comeback in economic thinking.

Scarcity? What scarcity?

Some argue that we are steadily moving from a period of natural resource abundance to one of scarcity, with significant political, economic and social consequences. Yet scarcity is often contingent on choices made about what is produced and local contexts as well as the result of political decisions. Hence, rather than using the singular, one should actually refer to scarcities in the plural.

Physical

Economic growth has put enormous strain on natural resources and will continue to do so. Since the 1970s, the global population has doubled, and economic activity (as measured by GDP) has grown fourfold, fuelled by fast-growing supply of materials, and has led to increased pressure on land and water. Inevitably, this raises the question of the sustainability of our use of natural resources.

‘Resource pessimists’ argue that many resources, like the Earth itself, are finite. Growing demand therefore accelerates their depletion. While they do not disagree with this basic argument, resource optimists, argue that technological developments can massively delay depletion.

The optimists take comfort in the fact that the real prices of mineral resources have hardly increased over time, and that reserves have remained largely stable or even increased as new sources are discovered. A recent study [xii] estimated full depletion of 33 key mineral resources to be in the hundreds of years (with copper the lowest at 100 years), although technological measures and controls on consumption could extend these periods by a factor of around 4.

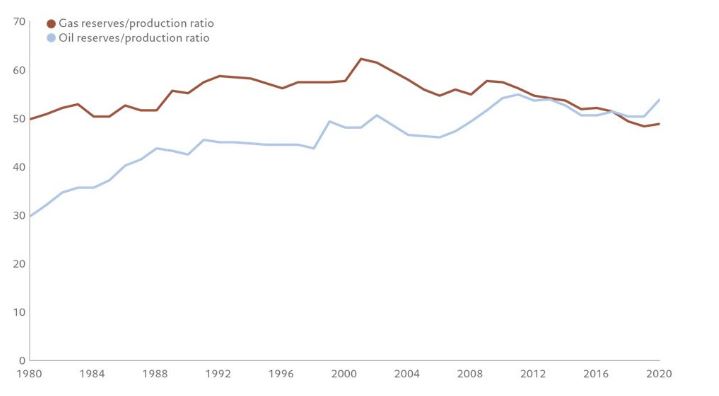

The reserve-to-production ratio of oil and gas has remained relatively stable in recent decades at around 50 years. Coal reserves are estimated to be much higher, at around 130 years of current annual production.

One could therefore argue that there is no immediate risk of shortages as far as minerals and fossil fuels are concerned. Yet, as the case of coal demonstrates, physical limitations are not the only driver of scarcity.

Environmental

Climate change and its potentially catastrophic consequences have been thoroughly documented by the United Nation’s Intergovernmental Panel on Climate Change (IPCC), propelling the need to cut greenhouse gas emissions to the top of the global agenda. The urgent need to cut emissions led to the 2015 Paris agreement, which commits countries to pursue efforts to limit global warming to well below 2°C above pre-industrial levels. The transition towards net-zero emissions represents a massive and unprecedented transformation of our economies and energy systems that requires a dramatic reduction in our consumption of fossil fuels. Limiting global warming to the more ambitious target of 1.5°C implies that 89%, 59%, and 58% of existing coal, conventional gas and oil reserves, respectively, would have to remain unburned [xiii]. How far fossil fuel consumption will be cut remains unknown, but the reduction will have to be significant for countries to deliver on their Paris agreement pledges. In short, we could be on the cusp of a period in which scarcity is driven by policies rather than physical constraints.

We could be on the cusp of a period in which scarcity is driven by policies rather than physical constraints.

Of course, environmental constraints may put additional pressure on resources by increasing the need for specific minerals that clean technologies depend on. The International Energy Agency expects total demand for the minerals needed for clean-energy technologies (e.g. copper, cobalt, nickel, lithium) to grow two-to-four-fold by 2040. Most of this extra demand will be driven by electricity networks and battery storage. But again, another kind of scarcity might come into play.

Geopolitical

Since the end of World War Two, globalisation has prompted a dramatic increase in world trade and unprecedented exploitation of natural resources. The end of the Cold War in 1991, China’s entry into the World Trade Organisation in 2001 and numerous free trade agreements across the world have accelerated this trend. Yet geopolitical tensions are on the rise again, and with them come tariff barriers, sanctions and trade restrictions. This means that control of key resources is becoming even more important than before, especially as access to some may even be weaponised. Russia’s decision to cut gas supplies to Europe after invading Ukraine in February 2022 is a case in point. A recent OECD trade policy paper [xiv] showed that export restrictions on critical raw materials are being increasingly imposed – most prominently by China, followed by India, Argentina, Russia, Vietnam and Kazakhstan.

Large discoveries of a natural resource can actually prove harmful to a country’s development as it struggles to cope with its newfound wealth, a phenomenon known as the ‘Dutch disease’ [xv]. Yet access to critical natural resources will remain a major factor in power relations in the years to come. Geopolitical considerations could increasingly become a third source of scarcity in the coming decade, with the risk that the hunt for resources turns into outright conflict.

Conclusion

Scarcity of resources for whatever reason is a multifaceted issue with which modern societies will increasingly have to reckon. Yet scarcity need not be a curse. Rather, it may also prove a formidable source of innovation that puts societies on a more sustainable path. Indeed, humans have shown enormous ingenuity in recent years, developing wind and solar power as an alternative to fossil fuels and moving closer to making nuclear fusion a viable source of energy.

Scarcity may prove a formidable source of innovation, putting societies on a more sustainable path.

Mankind may have no choice but to overcome the scarcity challenge anyway, since the alternative – famously argued in Jared Diamond's 2005 book of the same name – could well be societal and economic ‘Collapse’. But we are not there yet.

[i] Quesnay, François (1758).Tableau économique

[ii] Malthus, Thomas Robert (1798). An Essay on the Principle of Population

[iii] Jevons, William Stanley (1865). The Coal Question: An Inquiry Concerning the Prospects of the Nation and the Probable Exhaustion of Our Coal Mines

[iv] Ricardo, David (1817). Principles of Political Economy and Taxation

[v] Mill, John Stuart (1862). Principles of Political Economy, 5th ed.

[vi] Kurz, Heinz & Salvadori, Neri. (2009). Ricardo on Exhaustible Resources, and the Hotelling Rule.

[vii] Say, Jean-Baptiste (1928). Cours complet d’économie politique pratique

[viii] Solow, Robert M. (February 1956). A contribution to the theory of economic growth. Quarterly Journal of Economics.

[ix] Hotelling, Harold (1931). The Economics of Exhaustible Resources.

[x] Meadows & al (1972). The Limits to Growth: a Report for the Club of Rome’s Project on the Predicament of Mankind

[xi] Schumacher, E.F (1973). Small is Beautiful: A Study of Economics As If People Mattere

[xii] M.L.C.M. Henckens et al. (2016). Geological scarcity, market price trends and future generations

[xiii] Welsby, D., J. Price, S. Pye, and P. Ekins. 2021. Unextractable Fossil Fuels in a 1.5°C World. Nature 597: 230–234

[xiv] OECD (2023), Raw materials critical for the green transition. Production, international trade and export restrictions

[xv] Economic phenomenon where the rapid development of one sector of the economy, typically through the discovery of natural resources, results in a negative overall economic impact by precipitating the decline of the other sectors.

Important Information

This article is used for informational purposes only and does not constitute,on Pictet Asset Management part, an offer to buy or sell solicitation or investment advice. It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date. The effective evolution of the economic variables and values of the financial markets could be significantly different from the indications communicated in this document.