Discrete Performance

Discrete performance is the percentage performance of an investment over specific defined time periods. This is often expressed in calendar years or quarters of a year, with a comparison against a Morningstar category, benchmark, or an index. The calculation of discrete performance for funds generally uses total returns, with dividends reinvested.

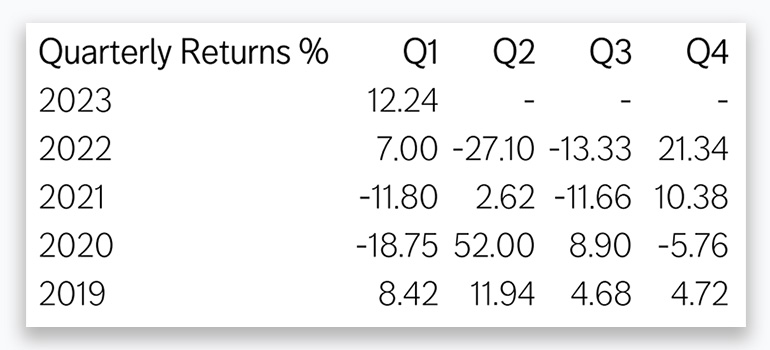

The below example from a fund factsheet on our fund centre shows how discrete performance is displayed based on quarters of a year over a five year period:

Discrete performance can be useful when used in conjunction with cumulative performance and annualised performance, which look at total performance and average annual performance over a total time period; discrete performance looks at specific portions of that overall time period. This can be useful to see whether a fund has consistently beaten or underperformed its benchmark or Morningstar category, for example.

It's important to note that performance includes the funds own management charge but excludes any product-specific related charges.

Past performance may not be repeated and should not be used as a guide to future performance.